Japan's Tax-Free Shopping System Explained (Major Changes in November 2026)

- Written by: Mizue Ito

Planning a trip to Japan and looking forward to some retail therapy? Get ready to shop till you drop without breaking the bank! This comprehensive guide will walk you through the ins and outs of tax-free shopping in Japan. From understanding what 'tax-free' really means to navigating the process, we've got you covered. We’ll also walk you through the changes coming in November 2026, so you can shop smart on your next trip.

This page contains promotional content

Top image: Tupungato / Shutterstock.com

- Table of Contents

-

- Major Changes Coming to Japan’s Tax-Free System in November 2026

- Can You Get Tax-Free Shopping Anywhere? What Qualifies as a Tax-Free Store?

- Who Is Not Eligible for Tax-Free Shopping?

- What Are the Conditions and Minimum Spend for Tax-Free Shopping?

- Important Notes on Tax-Free Purchases of Consumables

- How the Tax-Free Process Works

- Make Tax-Free Shopping Easier by Registering with Visit Japan Web

- Frequently Asked Questions

- Major Retailers Offering Tax-Free Services in Japan

- Stores That Do Not Offer Tax-Free Services

- Tax-Free Shopping Is Also Available Online

- Know the New Rules! Enjoy Tax-Free Shopping in Japan

- LIVE JAPAN Exclusive Discount Coupons

Major Changes Coming to Japan’s Tax-Free System in November 2026

Starting November 1, 2026, Japan’s tax-free shopping system for international travelers will undergo a major overhaul. The update aims to prevent misuse of tax-free purchases, improve the shopping experience for visitors, and reduce administrative work for stores. Here are the three key changes you should know about.

Shift to a Refund-Based System

The biggest change is the introduction of a refund-based system. Under the current system, consumption tax is waived at the time of purchase. However, starting in November 2026, travelers will pay the full amount—including tax—upfront, then receive a refund for the tax portion after clearing customs at departure.

Loosened Requirements for Tax-Free Purchases

To make the system easier for both travelers and tax-free retailers, several rules will be relaxed:

・The distinction between general goods and consumables will be eliminated

・The 500,000 yen purchase limit for consumables will be removed

・Special packaging requirements for consumables will no longer apply

・Shops will no longer need to assess whether items are for “everyday personal use”

New Departure Procedures at the Airport

At departure, travelers will verify their purchases by scanning their passport at a kiosk located in the airport’s public area. To reduce congestion, options for online processing and integration with self check-in machines are also being considered.

This new system is expected to streamline tax-free shopping and enhance the overall shopping experience for international visitors.

Can You Get Tax-Free Shopping Anywhere? What Qualifies as a Tax-Free Store?

“Tax-free” means you don’t have to pay Japan’s consumption tax on eligible purchases—but only if you buy from stores officially authorized as “Export Sales Shops” by the tax office. These include duty-free shops in airports, electronics stores, department stores, and more.

In recent years, tax-free services have expanded to department stores with centralized counters, large shopping malls, outlet centers, and even local shopping streets. Look for the official tax-free shop logo displayed at the store entrance.

Who Is Not Eligible for Tax-Free Shopping?

You may not qualify for tax-free shopping in the following cases:

・If you use an automated gate at immigration and your passport does not show an entry stamp

・If you’ve been in Japan for over six months

・If you are working in Japan

・If you do not meet the minimum purchase requirements

The tax-free system is intended for non-residents—specifically, foreign tourists who have been in Japan for less than six months, or Japanese nationals living abroad for over two years who are returning temporarily for less than six months.

What Are the Conditions and Minimum Spend for Tax-Free Shopping?

To qualify for tax-free shopping, the items must be for personal use (not for business or resale) and must be taken out of Japan.

For general goods like electronics, clothing, bags, and watches, the total amount spent at a single store on the same day must be at least 5,000 yen (excluding tax). For consumables like food, cosmetics, and medicine, the purchase must total between 5,000 and 500,000 yen and be packaged in a way that prevents domestic use.

In department stores or malls with a centralized tax-free counter, purchases from multiple stores can be combined to meet the 5,000 yen minimum. However, even if the spending threshold is met, some items may still not qualify depending on the category.

- Starting in November 2026, the distinction between general goods and consumables will be eliminated, along with the 500,000 yen purchase cap for consumables. Items will also no longer require special packaging or be judged based on whether they are for “everyday personal use.”

Important Notes on Tax-Free Purchases of Consumables

Consumables must be packaged in a sealed bag or box—often with a tamper-evident sticker—and cannot be opened before leaving Japan. Also, you generally cannot combine the value of general goods and consumables to meet the tax-free minimum; each category must independently exceed 5,000 yen.

However, if general goods are packaged in the same way as consumables to prevent use in Japan, their value may be combined. In such cases, neither type of item can be opened or used within Japan.

- Starting in November 2026, the distinction between general goods and consumables will be removed, and special packaging for consumables will no longer be required.

How the Tax-Free Process Works

There are two main ways to complete the tax-free process, depending on the store.

(A) Present your passport at checkout and pay the tax-exempt price immediately.

(B) At department stores or shopping malls with a centralized tax-free counter, you’ll first pay the full price (including tax) at each store. Later the same day, visit the tax-free counter with your items, receipts, and passport to get a refund. A service fee may apply. Stopping by the counter before shopping may also get you discount coupons.

At the store

1) Show your passport

Present your original passport—copies aren’t accepted. Store staff will verify your photo, name, nationality, birthdate, visa status, entry date, and passport number.

2) Receive explanations from the store

Since October 2021, the paper form for tax-free purchases has been abolished. Stores now send your purchase data directly to the National Tax Agency. Signing a purchaser’s declaration is no longer required, but staff will explain important details to you.

3) Payment and receiving your items

If using method (A), you pay the tax-free amount and receive your items. If using method (B), you’ll be refunded the tax after visiting the centralized counter. If your total spending drops below the minimum due to returns or exchanges, your tax exemption will be canceled and you’ll need to pay the consumption tax.

At the airport

4) Show your passport at customs

Your purchase info is sent electronically, but you still need to show your passport to customs. Tax-free items must be taken out of Japan by the purchaser. If you want to check the items in your luggage, inform the airline at check-in. A customs officer will come to confirm the tax-free goods before your baggage is checked.

- Starting in November 2026, travelers will verify their tax-free purchases by scanning their passport at a kiosk located in the airport’s public area. Online procedures and integration with self check-in machines are also being considered to streamline the process.

Make Tax-Free Shopping Easier by Registering with Visit Japan Web

Visit Japan Web is an online service that streamlines arrival procedures—quarantine, immigration, and customs—for travelers entering Japan, including returning Japanese citizens. It allows you to handle everything in one place.

Learn more here.

As of April 1, 2023, a new “Tax-Free Shopping” feature was added. By registering your passport details in advance, you can complete tax-free procedures without needing to show your passport at the store.

It’s simple to use: once your passport details (such as name, nationality, birthdate, visa status, entry date, and passport number) are uploaded, a QR code will appear under “Prepare for Tax-Free Shopping.” Show this code at participating stores, and staff will scan it to complete the process. Note that this function is only available at shops equipped to read the code, so check in advance. If not supported, you can still complete the procedure by presenting your passport directly.

For instructions on how to use the Tax-Free Shopping feature on Visit Japan Web, see the link above.

Frequently Asked Questions

Q1. What’s the Difference Between “Duty Free” and “Tax Free”?

A.

“Tax Free” refers to exemption from Japan’s consumption tax (value-added tax) only. “Duty Free,” on the other hand, includes exemptions from other taxes like customs duties, liquor tax, and tobacco tax in addition to consumption tax. Since departure areas past immigration in international airports are legally considered outside of Japan, they are designated as duty-free zones.

Aside from airports, there are only a few duty-free stores in Japan, such as T Galleria Okinawa by DFS, Japan Duty Free GINZA (8th floor of Ginza Mitsukoshi), and Lotte Duty Free Tokyo Ginza (8th and 9th floors of Tokyu Plaza Ginza).

Q2. What Do I Need for Tax-Free Purchases and Procedures?

A.

At the time of purchase, you must present your original passport—copies are not accepted. If you're using a centralized tax-free counter, you'll need your original passport, the purchased items, and the receipts.

Q3. I Forgot My Passport at the Hotel! Can I Complete the Tax-Free Procedure the Next Day?

A.

No—the tax-free procedure must be completed on the same day as the purchase. Your original passport is required at the time of purchase, so be sure to retrieve it from your hotel and return to the store the same day. (Also note that visitors to Japan must carry their original passport at all times.)

Q4. Can Someone Else Handle the Tax-Free Procedure for Me?

A.

No—only the person who made the purchase can complete the tax-free procedure. It cannot be done by a proxy.

Q5. I Used an Automated Gate and Don’t Have an Entry Stamp—Can I Still Use the Tax-Free System?

A.

To complete tax-free procedures, your passport must be presented and verified to confirm your non-resident status. If you use an automated gate at airports like Narita, Haneda, Chubu, or Kansai, your passport may not be stamped, which can prevent stores from verifying your eligibility. Be sure to inform the immigration officer at the gate that you need an entry stamp for tax-free shopping.

Q6. Can I Use Tax-Free Items in Japan After the Procedure?

A.

General goods may be used in Japan as long as you take them out of the country. However, consumables must remain sealed in their designated packaging—once opened, they no longer qualify for tax exemption. If you open or use them before departure, customs will charge tax. If the remaining untaxed items fall below the 5,000 yen threshold, all items may become taxable.

- Starting in November 2026, the distinction between general goods and consumables, as well as the 500,000 yen purchase cap for consumables, will be eliminated. There will also be no need to judge whether items are for “everyday personal use” or to apply special packaging for consumables.

Q7. Should Tax-Free Items Be Carried Onboard or Checked in as Luggage?

A.

Since the customs counter at the airport is located after security and carry-on baggage screening, tax-free items should be brought as carry-on luggage. This allows customs to inspect them during the declaration process. Do not check them in unless you have made special arrangements with your airline and customs staff.

Q8. Liquids Like Cosmetics and Alcohol Have Carry-On Limits—What Should I Do?

A.

On international flights, liquids in containers over 100 ml are not allowed in carry-on luggage and will be confiscated at security. Be sure to place any liquids over 100 ml into your checked luggage at the airline counter and inform staff accordingly. Liquids in containers of 100 ml or less can be carried onboard if they’re placed in a resealable, transparent plastic bag with a zipper, no larger than 1 liter (approximately 29 cm × 20 cm).

Q9. Can Someone Else Take My Tax-Free Items Home for Me?

A.

No—tax-free items cannot be transferred to someone else. Only the person who made the purchase is allowed to take them out of Japan.

Q10. How Does Tax-Free Shopping Work When Using a Credit Card?

A.

At stores with a centralized tax-free counter, such as department stores, you'll first pay the full price (including tax) with your credit card. After completing the procedure at the counter, the consumption tax refund will be credited back to your card—usually within 10 days to 2 weeks. At other tax-free stores like electronics shops, discount stores, or drugstores, you typically pay the tax-free amount directly at the time of purchase. Most stores accept credit card payments, but availability may vary by location.

Q11. Can I Pay with Points or Miles Instead of Cash?

A.

Whether you can use points or miles depends on the store, but most tax-free shops do not accept them. It’s generally recommended to pay with cash or a credit card.

Q12. Are There Tax-Free Shops Outside of Airports?

A.

Yes—many tax-free shops can be found outside airports, including department stores, electronics retailers, drugstores, and shopping malls.

Q13. What Kinds of Tax-Free Items Offer the Best Deals in Japan?

A.

A wide variety of items are eligible for tax exemption, but electronics like digital cameras and beauty or wellness devices often offer significant savings compared to prices abroad.

Popular tax-free picks also include cold medicine, cough drops, disposable eye masks, and other health-related goods—many of which are unique to Japan and affordably priced despite their high quality. Some drugstores and electronics shops also offer discount coupons, making your purchases even more cost-effective.

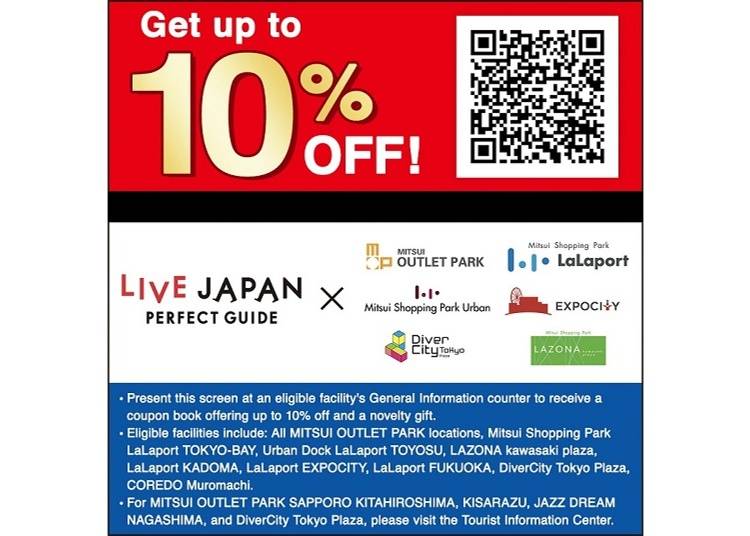

- LIVE JAPAN offers a wide range of discount coupons for electronics stores, drugstores, outlet malls, shopping centers, and tax-free shops. Be sure to grab them in advance to save more on your purchases!

Major Retailers Offering Tax-Free Services in Japan

In Japan, tax-free shopping isn’t limited to airports and department stores—it’s also available at shopping malls, discount stores, drugstores, and more. Below is a list of major retailers across different categories that support tax-free purchases.

Keep in mind that not all tenants within department stores or malls offer tax-free services, and even among nationwide chains, availability may vary by location. Be sure to check in advance before visiting.

- Airports

- Narita International Airport, Haneda Airport, Chubu Centrair International Airport, Kansai International Airport

- Department Stores

- Sapporo Mitsukoshi, Daimaru Sapporo, Tokyu Department Store Sapporo, Sendai Mitsukoshi, Keio Department Store, Odakyu Department Store, Sogo & Seibu Department Stores, Takashimaya, Tokyu Department Store, Tobu Department Store, Matsuya Ginza, Isetan Mitsukoshi (Tokyo), Keihan Department Store, Hankyu Department Store, Hanshin Department Store, Kintetsu Department Store Main Store Abeno Harukas

- Electronics Stores

- Yamada Denki, Edion, Nojima, Joshin, Kojima × Bic Camera, Best Denki, Bic Camera, Yodobashi Camera

- Shopping Malls

- AEON Mall (Asahikawa Ekimae, Narita, Osaka Dome City, etc.), Mitsui Shopping Park LaLaport (TOKYO-BAY in Funabashi, Toyosu, Yokohama, Koshien, etc.), Aqua City Odaiba, Tokyo Solamachi, Lumine (Shinjuku, Yokohama), Ario (Sapporo, Kasai), Ito-Yokado (Sapporo, Oimachi)

- Stationery

- Ginza Itoya

- Discount Stores

- Don Quijote, Takeya, Futaki no Kashiya, Komehyo, MrMax

- Drugstores

- Welcia, Tsuruha Drug, Cosmos Yakkyoku, Sundrug, Sugi Pharmacy, Matsumoto Kiyoshi, Daikoku Drug

- Japanese Brand Stores

- UNIQLO, MUJI, Sanrio Gift Gate

- Duty-Free Stores

- Japan Duty Free GINZA (8F of Ginza Mitsukoshi), Lotte Duty Free Tokyo Ginza (8F and 9F of Tokyu Plaza Ginza)

*Not all stores within department stores or shopping malls are tax-free eligible. Similarly, not all locations of nationwide chains like discount stores or drugstores support tax-free shopping. Please confirm in advance.

Stores That Do Not Offer Tax-Free Services

- Convenience Stores

- Stores like 7-Eleven, FamilyMart, and Lawson are generally not eligible for tax-free shopping. However, some locations in major cities like Tokyo and Osaka may offer tax-free services.

- Restaurants, Hotels & Services

- Dining establishments such as restaurants and cafés are excluded, as the goods are consumed in Japan. Similarly, intangible services like accommodation fees and service charges are not eligible for tax exemption.

Tax-Free Shopping Is Also Available Online

“Online tax-free” shopping lets you place orders before or during your trip and pick up items at your hotel, an airport, or a participating downtown tax-free store. It’s a convenient way to save shopping time and explore Japan hands-free without bulky bags.

A wide range of items is available, including electronics, medicine, cosmetics, snacks, stationery, kitchen goods, daily essentials, books, CDs/DVDs, souvenirs, and figurines. Payment and tax-free processing are done at the pickup location, so bring a device with internet access, your passport with your Japan entry date, and a credit card or e-money—cash payments are not accepted. Only the purchaser may collect the items.

Some DFS airport shops also offer a “pre-order” service, allowing you to reserve products online in advance and pick them up at the airport counter.

Online Tax-Free Shop

Know the New Rules! Enjoy Tax-Free Shopping in Japan

Understanding Japan’s tax-free system will help you make the most of your shopping experience. Don’t forget to keep an eye out for the major changes coming in November 2026—we’ll be updating you with the latest details on LIVE JAPAN. Be sure to check back regularly so you don’t miss out.

(This article was originally published in 2019 and updated in March 2025. For the most current information, please refer to official websites.)

LIVE JAPAN Exclusive Discount Coupons

Mitsui Outlet Park Coupon Book

Mitsui Outlet Park is a popular chain of outlet malls across Japan, offering a wide range of international and domestic brands at discounted prices on clothing, accessories, and lifestyle products in a pleasant, open-air setting.

BicCamera Tax-Free Coupon

BicCamera is a top pick among international travelers for its tax-free deals and extra discounts. With the “Tax-Free Discount Coupon” available at all BicCamera locations, you’ll get the standard 10% tax exemption plus an additional 3–7% off on select items like cameras, watches, electronics, medicine, cosmetics, and even sake (some exclusions apply). Simply show the coupon image at checkout to redeem the offer.

Don Quijote Tax-Free Coupon

Don Quijote, commonly known as "Donki," is a popular discount chain offering a vast array of products, from electronics and cosmetics to snacks and novelty items. Its lively atmosphere and late hours make it a unique shopping destination.

Now, you can enjoy up to 17% off your purchase at Don Quijote! Simply tap the coupon above and show it to the cashier at checkout. (Conditions apply. See coupon page for details.)

Lotte Duty Free Ginza

Lotte Duty Free Ginza, in Tokyo's upscale Ginza district, is a premium duty-free shop featuring luxury brands and products. Offering high-end cosmetics, fragrances, and designer accessories, it's an ideal destination for tax-free shopping in a refined setting.

Sapporo Drug Store (SATUDORA) Tax-Free & Special Discount Coupon

With a history spanning over 50 years, Sapporo Drugstore (SATUDORA) operates 200+ stores mainly in Hokkaido, covering popular tourist spots like Sapporo, Otaru, Hakodate, and beyond, with additional branches in Okinawa and Taiwan. SATUDORA offers a range of popular medicines,cosmetics, and exclusive Hokkaido souvenirs.

AEON MALL Coupon

Aeon Mall is a leading shopping mall chain in Japan, providing a complete shopping experience with a variety of retail stores, entertainment options, and dining venues. It's a family-friendly destination that caters to diverse needs and preferences.

Laox Tax-Free & Special Discount Coupon

Laox offers a wide selection of products including home appliances, household goods, hobby items, and traditional crafts. Multilingual staff (Japanese, Chinese, and English) are available to assist you, and the store provides free Wi-Fi and restrooms for all visitors.

Edion Tax-Free & Special Discount Coupon

Edion, a major electronics store chain in Japan, provides both tax-free shopping and exclusive discounts with this special coupon. Save more on home appliances, beauty gadgets, and daily electronics.

Tsuruha Drug Store Tax-Free & Special Discount Coupon

Tsuruha Drugstore is a popular pharmacy chain in Japan, known for its wide range of health and beauty products. It's a go-to destination for both medicinal needs and cosmetic treasures, including sought-after Japanese skincare and makeup items.

Japan Duty Free Fa-so-la Mitsukoshi Isetan Tax-Free Coupon

Japan Duty Free GINZA, located on the 8th floor of Mitsukoshi Ginza and opened on January 27, 2016, is Japan’s first airport-style downtown duty-free shop outside of Okinawa. Enjoy duty-free prices on luxury brands, cosmetics, and more—all without going to the airport.

Odakyu Department Store Shinjuku Special Discount Coupon

Use this 6% discount ticket at Odakyu Department Store Shinjuku to save on your purchases.

Takeya Special Discount Coupon

Takeya, the iconic discount store in Tokyo’s Ueno area, offers a wide variety of products—from daily goods and cosmetics to snacks and electronics. Use this special coupon to enjoy extra discounts.

Sundrug Special Discount Coupon

Sundrug is a popular drugstore chain offering great deals on cosmetics, health products, medicine, and daily essentials. With this special coupon, you can enjoy additional savings.

Joshin Special Discount Coupon

Joshin is a trusted electronics retailer in Japan, offering everything from home appliances and audio equipment to gaming devices and hobby goods.

AOKI Special Discount Coupon

AOKI is a leading Japanese retailer specializing in business suits, formalwear, and casual clothing. Use this special coupon to get extra discounts on top of your tax-free savings.

ORIHICA Special Discount Coupon

ORIHICA offers stylish business and casual wear with a modern twist, perfect for both work and everyday use. Take advantage of this special coupon to enjoy additional savings along with tax-free benefits.

Special Discount (NINJA Wifi)

Get 20% off when you book via the special site. Click on the banner below! The 20% discount currently applies only to Pocket WiFi rentals. It will extend to SIM cards and eSIMs around summer 2025.

Web writer and editor. After graduating from university, I worked as a director in the web industry before switching to the apparel industry. Upon becoming a parent, I became a freelancer, leveraging the knowledge I gained in the web industry and the communication skills I developed in the customer service roles of the apparel industry to work in various fields. My main achievements include managing advertisements on e-commerce platforms, editing content related to welfare, and editing and writing travel information. Drawing from my hobby of family camping, with 10 to 20 trips a year, I am also proficient in the outdoor domain. After living in the metropolitan area for about 20 years, away from my hometown in Nagano Prefecture, I realized the allure of living in rural Japan and decided to relocate with my family. I am now engaged in writing activities to convey this charm.

*Prices and options mentioned are subject to change.

*Unless stated otherwise, all prices include tax.

Recommended places for you

-

Kambei Sannomiyahonten

Yakiniku

Kobe, Sannomiya, Kitano

-

ISHIDAYA Hanare

Yakiniku

Kobe, Sannomiya, Kitano

-

Appealing

Rukku and Uohei

Izakaya

Sapporo / Chitose

-

Kanzenkoshitsuyakinikutabehodai Gyugyu Paradise Sannomiya

Yakiniku

Kobe, Sannomiya, Kitano

-

Goods

Yoshida Gennojo-Roho Kyoto Buddhist Altars

Gift Shops

Nijo Castle, Kyoto Imperial Palace

-

Jukuseiniku-to Namamottsuarera Nikubaru Italian Nikutaria Sannomiya

Izakaya

Kobe, Sannomiya, Kitano

-

Safe and Comfortable Summer in Japan! Sunscreen, Cooling Hacks & Other Child-Friendly Summer Essentials

by: Chehui Peh

-

'They Do What in the Toilet?!' Italians Shocked By These Japanese Beauty Quirks

by: Yuu Sato

-

Japanese hotel offering sports car touge tours, no Japanese-language ability required

-

Spray Your Shirt Cold?! Japan's Smartest Sweat-Fighting Hacks You Can Buy at Don Quijote

by: Chehui Peh

-

Stay Cool and Protected: Japanese UV & After-Sun Products You'll Love

by: Chehui Peh

-

This Japanese train station has its very own hot spring bathhouse, right on the platform【Photos】

-

Discover Japan Duty Free GINZA: A Unique Shopping Experience in the Heart of Tokyo

by: Chehui Peh

-

Todai-ji Temple: Home to the Great Buddha of Nara - And a Nose Hole That Brings You Luck!?

by: WESTPLAN

-

8 Unfamiliar (But Totally Normal) Customs in Japan!

-

Otaru Travel Guide: Inside Hokkaido's Leading Destination (Sightseeing, Food, and Shopping Tips)

-

Sightseeing Highlights: Experience the Appeal of Kyoto Geisha Culture

-

Lotte Duty Free Tokyo Ginza: Your Duty-Free Shopping Destination in the Heart of Tokyo

by: Chehui Peh

- #best sushi japan

- #what to do in odaiba

- #what to bring to japan

- #new years in tokyo

- #best ramen japan

- #what to buy in ameyoko

- #japanese nail trends

- #things to do japan

- #onsen tattoo friendly tokyo

- #daiso

- #best coffee japan

- #best japanese soft drinks

- #best yakiniku japan

- #japanese fashion culture

- #japanese convenience store snacks