People living in Japan have a variety of options when choosing a bank. Similar to other countries, you can choose from large domestic banks, small regional banks, international banks and others.

Banking Options

Several domestic banking institutions are available for your needs in money management. Most banks offer similar services including deposits and withdraws with bank book and cash cards, transferring funds, foreign currency exchange, and other services. Normal banking hours for banks are weekdays from 9:00 a.m.to 3:00 p.m.

Large domestic banking companies include:

• Bank of Tokyo - Mitsubishi UFJ

• Mizuho Bank

• Sumitomo Mitsui Banking

• Resona Bank

• Shinsei Bank

• Japan Postal Bank

Some banks are favorable to international residents with convenient services that make the banking process simpler. Here are is a brief description of such banks:

Bank of Tokyo - Mitsubishi UFJ

Obtaining a credit card can be a tough task for international residents, so as an alternative, you can obtain a Mitsubishi UFJ Visa debit card. MUFJ only requires that you've been a resident in Japan for at least 6 months. Upon applying you will receive your debit card in the mail after 2 weeks. UFJ will also give you a bank book and a cash card to use at ATM’s (the debit card cannot be used at the ATM).

Shinsei Bank

With Shinsei Bank you can open an account without ever having to visit a bank building. You can apply online, Shinsei will send you a packet to fill out, send it back, and then they’ll send you an ATM cash card. They also offer their services in English, something many banks in Japan still lack. Shinsei Bank also offers lines of credit such as Visa cards, mortgages, and auto loans. Their online banking is also in English.

Japan Postal Bank

JP Post bank is a good option, allowing people with shorter stays in Japan to open an account, but with some restrictions for the first six months, such as not being able to wire transfer between banks. This simple bank account will allow depositing and withdrawing to your account. After six months the restrictions are lifted.

Opening a Bank Account

Getting a bank account is one of the first tasks when living in Japan, as an account is required for paying for many services and utilities such as cell phones, and for setting up automatic payments. The banks you can apply for depend on your visa and the length of your stay. Some banks may not allow you to create an account if you have a visa for less than one year. Banks such as Shinsei and Japan Postal Bank are known to be accommodating to people with shorter stays. Work or Spousal visas will allow you more options for bank accounts.

Banks require different forms of documentation in order to open an account:

- Residence Card

- Passport

- A registered Inkan/Hanko (Name Seal)

- Residence Certificate

- Money to deposit

Depending on the bank you go to, their English services may be limited, so if you're not confident in your Japanese language capabilities, it may be good to go with a friend that can assist you with any questions that might arise.

Banking Basics

• Bank ATMs

Cash cards can be used at many convenience stores and other locations but often with an ATM fee. Bank ATMs from the same bank will not charge you usage fees, however some close at night depending on the bank, while some others stay open 24 hours. Many banks have deals with certain convenience stores to waive the ATM usage fee. You can deposit, withdraw, view your balance, pay your bills, and get access to other services from bank ATMs.

• Bank Books

You will receive a bank book after creating a bank account. ATMs have a slot to insert your bank books which will automatically update the information in your bank book after a deposit or withdraw.

*Prices and options mentioned are subject to change.

*Unless stated otherwise, all prices include tax.

Popular Tours & Activitiess

Recommended places for you

-

Jukuseiniku-to Namamottsuarera Nikubaru Italian Nikutaria Sannomiya

Izakaya

Kobe, Sannomiya, Kitano

-

Appealing

Rukku and Uohei

Izakaya

Sapporo / Chitose

-

ISHIDAYA Hanare

Yakiniku

Kobe, Sannomiya, Kitano

-

Kambei Sannomiyahonten

Yakiniku

Kobe, Sannomiya, Kitano

-

Kanzenkoshitsuyakinikutabehodai Gyugyu Paradise Sannomiya

Yakiniku

Kobe, Sannomiya, Kitano

-

Goods

Yoshida Gennojo-Roho Kyoto Buddhist Altars

Gift Shops

Nijo Castle, Kyoto Imperial Palace

-

Ad

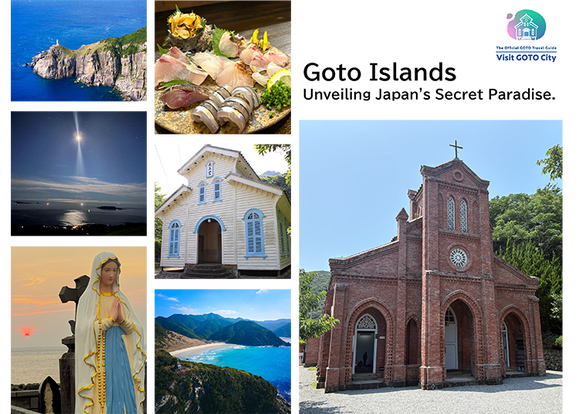

Walk in the Footsteps of Believers: A 4-Day Pilgrimage Across Goto Islands, Nagasaki Prefecture

by: Yohei Kato

-

Enjoy Japan's Gorgeous Winter Lights! Ride the Romancecar to Shonan no Hoseki Illumination

by: Guest Contributor

-

LaLaport TOKYO-BAY North Building Now Open: Shop, Dine & Enjoy Events at LaLa arena, Just 2 Stops from Disney

by: Wemmy Chau

-

Get Ready to Catch 'Em All! First Ever Permanent Outdoor Pokémon Park Opening Near Tokyo!

-

2025 Autumn Colors Report: Kurobe Gorge Nearing Peak

by: Timothy Sullivan

-

A Travel Game Changer! Go Hands-Free Between Tokyo and Kyoto with LUGGAGE EXPRESS by JTB and JR Tokai

by: Guest Contributor

-

Tokyo Station Top 10 Sweets Ranking!

-

Sendai Food Guide: What to Eat and Where to Savor Local Delicacies

-

5 Amazing Kyoto Festivals You’ll Want to Experience During Your Next Trip

-

Japanese Foods List: 16 Crazy Tasty Japanese Tohoku Region Dishes You've Never Heard of

-

Souvenir Hunt in Ikebukuro’s Tobu Department Store: Sweets and Desserts that are Both Tasty and Fancy!

-

The Ins and Outs of Everyone’s Favorite Train Bento

- #best sushi japan

- #what to do in odaiba

- #what to bring to japan

- #new years in tokyo

- #best ramen japan

- #what to buy in ameyoko

- #japanese nail trends

- #things to do japan

- #onsen tattoo friendly tokyo

- #daiso

- #best coffee japan

- #best japanese soft drinks

- #best yakiniku japan

- #japanese fashion culture

- #japanese convenience store snacks