Understanding Consumption Tax and Tax-Free Shopping in Japan

- Written by: Yusuke Ito

When traveling abroad, understanding the tax system can be challenging. If you've ever found yourself thinking, "This seems a bit pricey," while shopping, it could be due to sales tax. Japan also has a consumption tax. To help you avoid any surprises at the register, this article will explain Japan's consumption tax.

- Table of Contents

-

- How the Consumption Tax System Works in Japan

- Reduced Tax Rate Tips for Shopping at Supermarkets

- How the Consumption Tax Exemption System for Foreign Travelers Works

- Key Points for Using the Tax Exemption System

- Start of Digital Tax Exemption System

- Don't Confuse "Duty-Free" with "Tax Free"

- Departure Tax Implemented Since January 2019

How the Consumption Tax System Works in Japan

Consumption tax is a tax broadly collected by adding it to the price of goods and services. It has been over 30 years since Japan first introduced a 3% consumption tax in 1989. Gradually increasing over the years, the tax rate finally rose from 8% to 10% in October 2019.

Raising the consumption tax has a positive aspect, as the government uses this revenue to improve society. However, it also has a negative aspect, as it can reduce domestic consumption and hinder economic growth. To prevent a decline in consumption when the tax was raised to 10% in October 2019, the Japanese government introduced a system called the reduced tax rate. This system is complex and difficult to understand even for Japanese people, and it might be inconvenient for foreign travelers.

Reduced Tax Rate Tips for Shopping at Supermarkets

The reduced tax rate is a system that keeps the consumption tax at 8% for essential items. Typical examples of such items are food and beverages, including vegetables and fruits. However, a complicated issue arose when the government excluded dining out from the reduced tax rate.

This led to the question, "If you eat a bento bought from a supermarket in the eat-in area, does it count as dining out?" The Japanese government's stance was, "A bento bought from a supermarket is subject to the reduced tax rate of 8%. However, if you eat it in the eat-in area, it counts as dining out, so the consumption tax is 10%." This means customers must inform the cashier if they plan to eat in the eat-in area, making it a cumbersome system.

The reduced tax rate, which sparked mixed reactions in Japan, fortunately did not cause major confusion, partly due to the increased use of electronic registers and cashless payments via apps. The duration of this reduced tax rate system is still undecided.

Under the consumption tax system, if you buy an item for 1,000 yen, you must pay a total of 1,100 yen, including 100 yen as consumption tax. However, there is also a system in place that exempts foreign travelers from some of the consumption tax.

How the Consumption Tax Exemption System for Foreign Travelers Works

Tax exemption is a system that exempts non-residents, such as foreign travelers, from consumption tax when purchasing "specified items" in a "specific way." To use this tax exemption system, foreign travelers need to shop at stores designated as tax-free. Look for signs that say "Tax Free" or "免税" outside the store.

Specified Items:

Specified items are categorized into general items and consumables. For example, luxury items such as electronics, bags, and watches are considered "general items." In this case, purchases must total at least 5,000 yen (excluding tax) per store to qualify for tax exemption. On the other hand, everyday items such as tissues, cosmetics, and medicines are classified as "consumables." For consumables, the total amount must be between 5,000 yen and 500,000 yen to be eligible for tax exemption.

Specific Way:

The specific way refers to following the designated tax exemption procedures. For example, it is mandatory to present your passport when purchasing goods. Additionally, you must show the "purchase record" to customs when leaving the country.

Key Points for Using the Tax Exemption System

When purchasing "consumables" using the tax exemption system, you must not open the bags or boxes until you leave the country. If opened, it is considered consumption within Japan, and you may lose the tax exemption. However, it is fine to open "general items." Customs will check your items when you leave Japan, so be careful not to open the bags or boxes.

Until 2018, it was not possible to combine general items and consumables for tax exemption calculations. However, after the system was revised in 2019, general items can be combined with consumables for tax exemption if they are packaged in a specified way. Here are some examples to make this clear:

Case 1

If you purchase a 3,000 yen bag (general item) and 2,500 yen cosmetics (consumables), neither qualifies for tax exemption as both amounts are less than 5,000 yen.

Case 2 (since 2019)

If you purchase a 3,000 yen bag and 2,500 yen cosmetics, both are treated as consumables, and since the total purchase amount is over 5,000 yen, they qualify for tax exemption.

Start of Digital Tax Exemption System

From April 2020, the procedures at duty-free shops will be digitized. You will still need to present your passport when purchasing goods, but you will no longer need to sign documents or have a purchase record form attached to your passport.

The purchase records will be digitized and sent to customs. Based on this data, customs will check it during the departure procedures. Until September 30, 2021, there will be a transition period for digitization, and some stores will continue to use the traditional procedures for a while.

Don't Confuse "Duty-Free" with "Tax Free"

Even if you are a foreign traveler, you cannot get a consumption tax exemption at any store just by showing your passport. Stores that want to sell products under the tax exemption system need to obtain prior approval from the government, and unfortunately, not all stores in Japan have this approval.

You can identify tax-free stores by looking for signs that say "Tax Free" or "免税" at the storefront. Department stores, famous stores like Uniqlo and Bic Camera, as well as convenience stores, are among those that have tax-free status.

By the way, make sure not to confuse "duty-free" with "Tax Free." Duty-free shops offer a wide range of tax exemptions, including alcohol tax, tobacco tax, and customs duties. You need to present your passport and airline ticket when purchasing, and you will receive the purchased items at the airport. On the other hand, at "Tax Free" shops, only the consumption tax is exempted. You only need to present your passport at the time of purchase, and you can receive the items on the spot.

Departure Tax Implemented Since January 2019

The departure tax is a tax imposed when leaving Japan. A fee of 1,000 yen is collected per departure. Similar to airport usage fees, it is added to the cost of your airline ticket or tour package, so travelers do not need to pay it individually.

The tax does not apply to children under 2 years old, transit passengers (departing within 24 hours of entering Japan), or people who made an emergency landing in Japan due to weather or other reasons. The departure tax is a system adopted by many countries, including China and the United States.

I work as a writer and photographer. Every month, I cover more than 10 restaurants in Tokyo. I eagerly down all the dishes served, so lately I've gotten a bit chubby. My jogging routine hasn't yet had an effect on my waistline.

*Prices and options mentioned are subject to change.

*Unless stated otherwise, all prices include tax.

Popular Tours & Activitiess

Recommended places for you

-

Fine Dining on Rails? Japan Announces Stunning NEW 'Laview' Restaurant Train

-

Ad

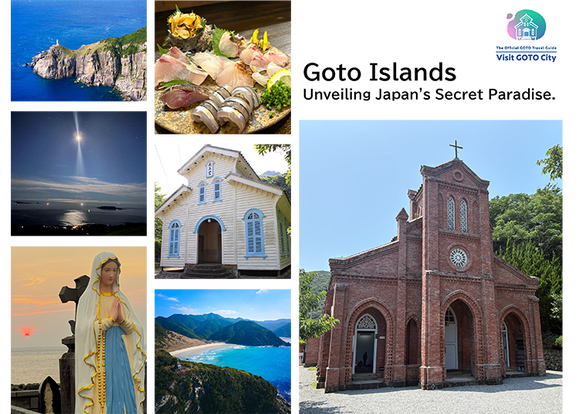

Unraveling the History of the Hidden Christians from Goto Islands, Nagasaki Prefecture, located in Kyushu

by: Yohei Kato

-

2025 Japan Autumn Color Report: Northeastern Japan Nearing Peak

by: Timothy Sullivan

-

Ad

Walk in the Footsteps of Believers: A 4-Day Pilgrimage Across Goto Islands, Nagasaki Prefecture

by: Yohei Kato

-

The Ultimate Guide to Mitsui Outlet Parks in Japan (2025 Edition) - Popular Tax-Free Malls & Coupon Info for Travelers

-

(12% OFF KKday Coupon) Mt. Fuji Autumn Leaves, Powder Snow & More! 15 Best Tours to Experience Japan in Fall & Winter

Inspiration for Accommodations

-

Enjoy Mt. Fuji from the Comfort of Your Room! Recommended Ryokan with Mt. Fuji View

-

Stay Near the Cherry Blossoms! Hotels for Cherry Blossom Viewing in Tokyo

-

Family-Friendly Hotels with Free Shuttle to Disneyland: Convenient Access for a Magical Stay

-

Top Ranked Hakone Hotels with Mt. Fuji View: Enjoy Stunning Scenery from Your Private Space

-

Convenient Tokyo Hotels with Airport Shuttle: Ideal for Families and Heavy Luggage

-

Stunning Tokyo Tower View Hotels: Enjoy Spectacular Scenery from Your Private Space

-

Convenient Asakusa Hotels with Kitchens: Ideal for Extended Family Visits

-

Experience Luxury: Hakone's 10 Best Five-Star Accommodations

-

Enjoy Mt. Fuji Autumn Leaves! Top Hotels Near the Popular Autumn Leaves Corridor

-

Experience Hakone Fall Foliage from Your Room with Stunning Views

-

Lush Nature and Gourmet Delights: Explore Tokyo’s Fun, Famous Rooftops!

-

10 Important Japanese Phrases to Know Before You Enter a Japanese Convenience Store!

by: Teni Wada

-

Top 7 Popular Japanese Mushrooms That Are Both Tasty and Healthy

-

Complete Guide to Buying Japanese Medicine in Japan: Phrases and Vocabulary You Need to Know

-

Ikebukuro Station Area Guide: Top 15 Spots When You Escape the Station's Maze!

-

Can Art Explain Godzilla? Tokyo's New Exhibit Takes a Shot

- #best ramen tokyo

- #what to buy in ameyoko

- #what to bring to japan

- #new years in tokyo

- #best izakaya shinjuku

- #things to do tokyo

- #japanese nail trends

- #what to do in odaiba

- #onsen tattoo friendly tokyo

- #daiso

- #best sushi ginza

- #japanese convenience store snacks

- #best yakiniku shibuya

- #japanese fashion culture

- #best japanese soft drinks